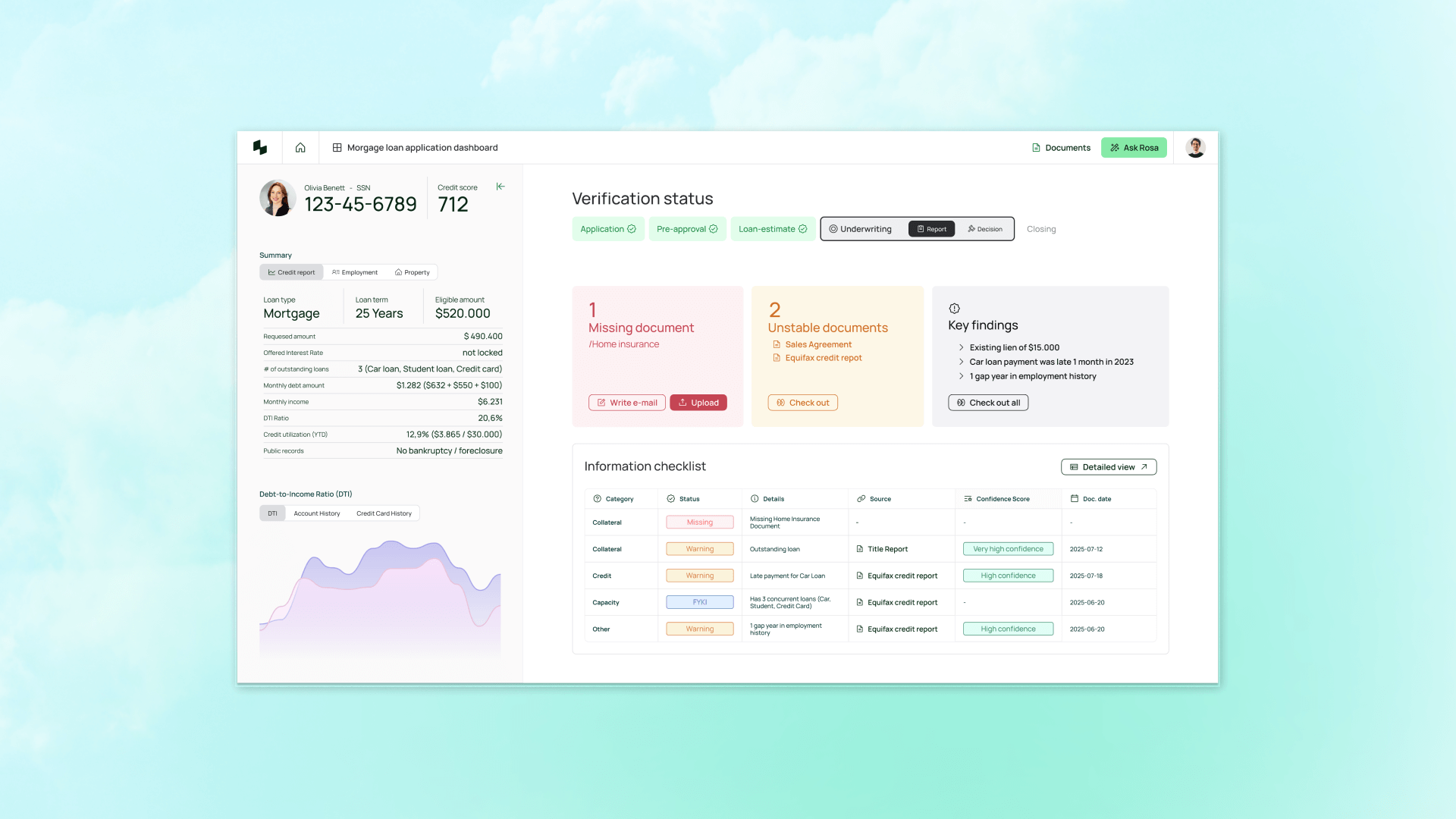

AI and data services for enterprise banks: automate 90% of routine work

Speed up decisions, outpace competitors, and retain customers with proven AI and analytics—custom-built on your data, within your infrastructure and security framework.

- Accelerated underwriting

- Automated customer support

- Fraud detection & monitoring

Trusted by 200+ enterprises globally

AI and data solutions we deliver

Already deployed by tier-1 banks and fintech in Europe and the US

6-8 weeks to ROI

Custom-built from reusable components, modular, configured to your exact needs—low-risk, high-impact, fast validation time.

Reliable and accurate

Unbiased, grounded in your data, and fine-tuned AI to reach the accuracy that you need—30% more accurate on average compared to off-the-shelf.

Secure and compliant

Deployed entirely on your infrastructure, integrated into your workflows and scoring models—data never leaves your systems.

Success stories from our clients

Don't take our word for it...

“Hiflylabs solved a location-based retail pricing problem. We’ve been working together on data-driven challenges ever since.”

István Mag

-Head of Digital Factory, MOL Group

Why tier-1 banks trust Hifly

We’ve done this before

Proven track record delivering pragmatic data, AI, and analytics to major bank groups like Intesa San Paolo and UniCredit. You get reusable blueprints, proven best practices, and deep vertical expertise.

70% AI-to-production rate

AI that actually delivers ROI—not pilots that waste budgets. Hifly boasts a higher AI-to-production rate than the market average thanks to field-tested methodology, mature ML and data science expertise, and partnerships with top AI, data, and cloud platforms.

Built to fit, not to break

We build on your existing data and infrastructure, integrate with your current systems, and fit into your security and compliance requirements. You keep working while we’re doing our job in the background—no disruption, no operational risks.

Guaranteed adoption

Change management is built into our process. We integrate solutions into your workflows, train your teams, and make sure your people can actually use what we build—while customers notice the speed, not the change.