PE data, AI, and analytics services to 4x your speed

Time kills deals. Accelerate deal evaluation, portfolio management, and market response with secure, verifiable AI and analytics. Custom-built on your data, deployed in your infrastructure, trusted at Fortune 500 scale.

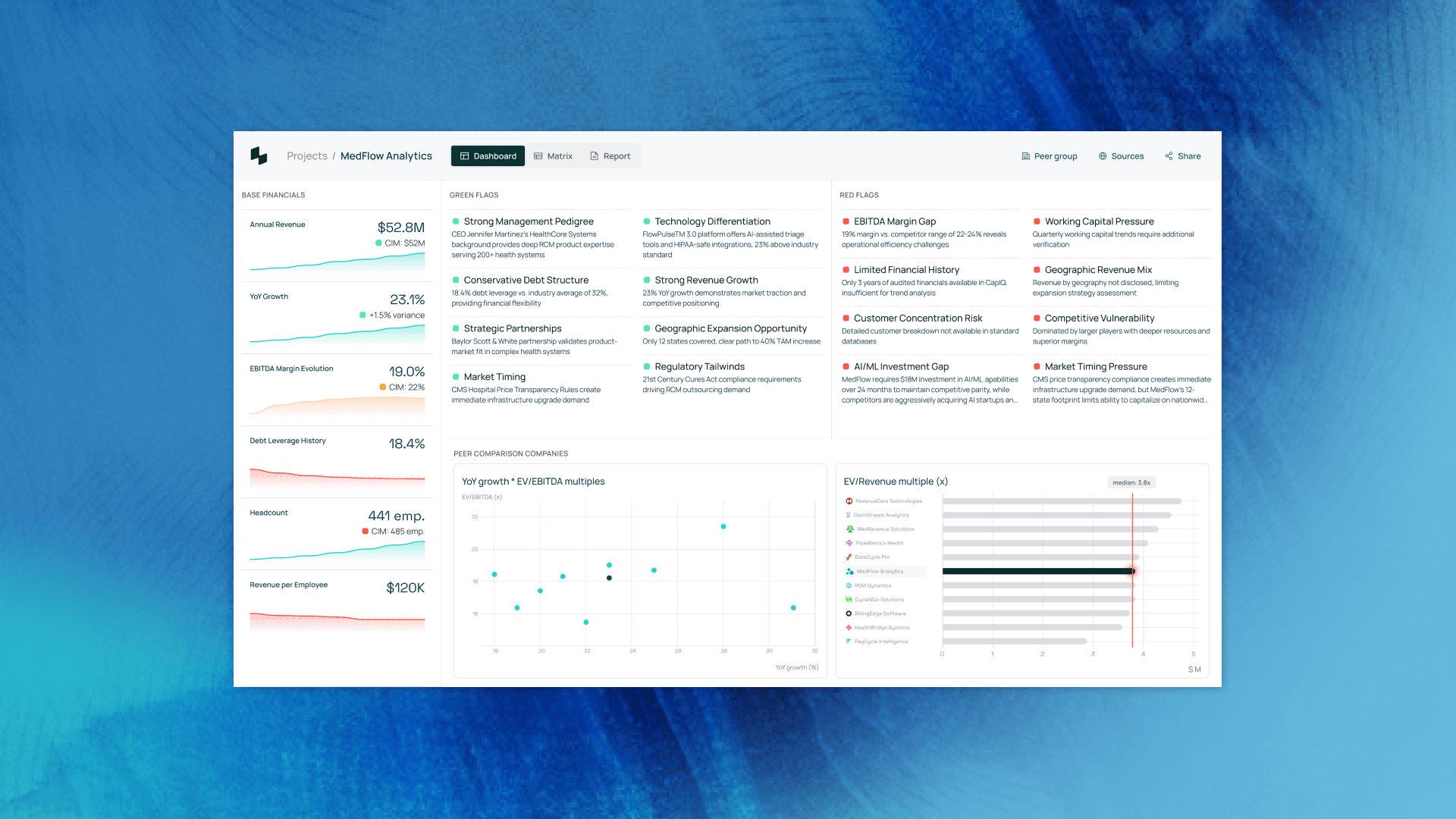

- Intelligent deal evaluation

- Automated risk assessment

- Real-time portfolio monitoring

Trusted by 200+ enterprises globally

AI and data solutions we deliver

Tested and deployed by leading PE firms in Europe and the US

Designed around your people

We run design workshops with your analysts and deal teams to build the features, logic, and workflows that fit your operations and match your needs.

Custom-built, set up in weeks

Custom-built from reusable components and configured to your investment thesis. Deployed on your infrastructure in 6-8 weeks—low-risk, high-impact.

Scales with you

Add features, integrate new data sources, and adjust workflows on demand as your portfolio grows and priorities change.

FOR PE TIRED OF SPREADSHEETS, PDFS, AND NUMBERS THAT DON’T ADD UP

Move at big player speed with AI and data advantage

Stop losing deals to manual screening, poor data, and inconsistent metrics. Start making profitable decisions that nurture your portfolio and grow your IRR—faster than anyone else in the market.

Success stories from our clients

Don't take our word for it...

“The Hifly team worked independently and smartly, integrating with our own team to level up our ability to tackle practical NLG problems.”

David Rosen

-CEO & Co-founder, Catylex

Why Fortune 500 PE trust Hifly

We've done this before

Hifly delivers pragmatic AI, data, and analytics already tested by tier-1 private equity and financial institutions—not an inflated AI promise or 200-page strategy decks. You see ROI in weeks, not after a year-long transformation.

Mature methodology

You get field-tested blueprints, reusable components ready for production, plus deep expertise and partnerships with top AI, data, and cloud platforms. This means faster time to market, lower risk, and reliable solutions that won’t compromise your legal, financial and reputational standing.

Built for your thesis

Off-the-shelf products can't differentiate you. Custom solution tailored to your investment thesis, portfolio structure, and operational model can. You own the IP, control the roadmap, and build a moat around your data. No vendor lock-in, no scaling traps, no dependency.

Guaranteed adoption

We guarantee adoption with change management, enablement, proactive support, and knowledge transfer built in from day one. We workshop your solution with the people who'll actually use it—deal teams, analysts, operators. So they can adopt it fast and rely on it confidently.