Throwing quick-and-dirty fixes at a declining product is like treating a fractured bone with painkillers alone. Sure, you might be able to take a few steps, but you need holistic intervention in the long run. You must stop and consider what needs fixing, what your environment looks like, and how you can mix-and-match the two for a tailored solution.

Know yourself

The methodologies of product discovery (and its various schools of thought) encourage you to stop and think. It goes well beyond market analysis, taking a good look at users, competitors, your own performance metrics, technologies, organizational capabilities, and business goals.

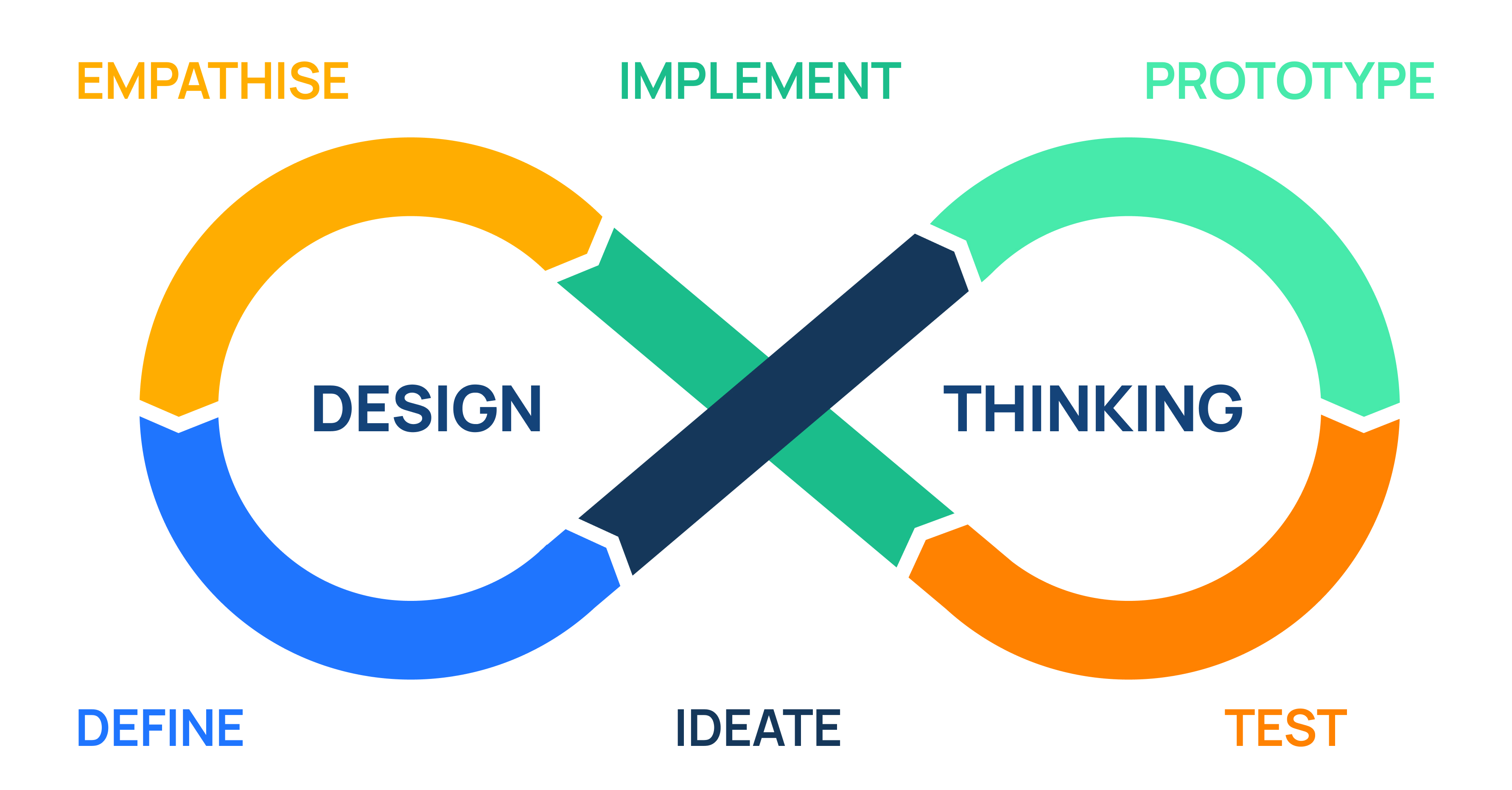

The standard Design Thinking process

By investing time and effort into mapping out these factors, you are given all the tools to create a vision and a roadmap for your product to bring everyone on the same page, and create a feasible strategy that generates value even short term.

Our methodology is rooted in Design Thinking, a heavily iterative, challenge-focused approach to product discovery. It begins with building up empathy through understanding of your surroundings, and moves forward with a cycle of ideation, prototyping, and testing, benchmarking, calculating and testing until a solution is reached.

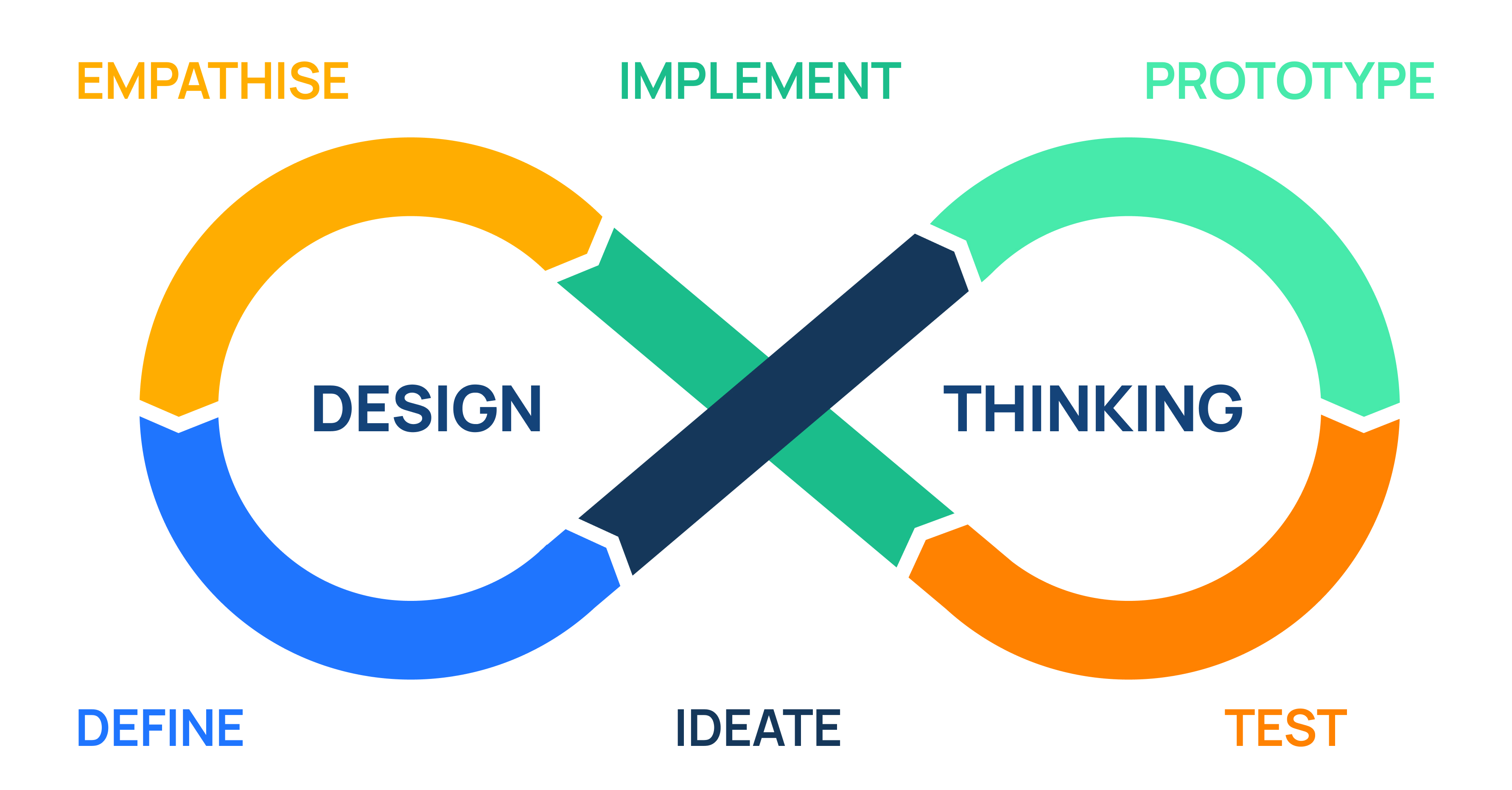

Our approach to creating digital experiences

There are several other approaches, though, so we recommend looking into the various frameworks to find the one that fits your organization and goals the most.

Last year, we worked with Central Media Group on a comprehensive strategy for their healthcare platform. As the project’s exact details are under NDA, let’s take a look at an example from a product discovery PoV, grounded in the public details of the previously mentioned project. We’ll use some mockup values in the example, but the takeaway remains.

Look internally—discover

Companies are made of people with their own views and understanding on certain things and problems, poisoned with biases. It is costly but highly important from time to time to have an objective understanding of your organization, technological capabilities, product KPI’s, internal services, and so on. Otherwise, you just won’t have the foundation for any type of strategy to be actionable and feasible.

Is your killer feature really that unique? If it is, is it performing the way it should? Are your expectations towards your product feasible? Are the different teams working on your product aligned?

We’re looking for answers to such questions in the internal research phase. It’s the most thorough X-ray imaginable of that fractured bone. Rather than taking everything at face value, we examine exact performance metrics and other aspects of products. Different domains and project goals come with different metrics—while a subscription model will focus on long-term retention, an ad-based system includes metrics such as:

- The most powerful traffic sources

- Rate of organic traffic

- User engagement, bounce & click-through

- Most and least popular functions

- Revenue streams

- The overall product strategy to drive performance

This is just the surface, though. For a really thorough internal analysis, comparing goals and expectations with past results is just as crucial. At the same time, these goals must be aligned within the organization as well—otherwise, one team is treating your fracture with proper care, while the other swears by the hair of the dog and wants to keep doing the same thing.

Product and marketing teams may be aware of the right type of content to drive revenue in your media outlet, but are your writers properly briefed? Are your retargeting and ad pipelines set up properly? Are you focusing your innovation efforts on the right thing?

By asking such questions, you can foster communication and collaboration within the organization, identify and resolve bottlenecks, and make sure that resources are allocated properly. We believe that only through highly cooperative, workshop-based and user-focused methods can we create true value—make sure that every stakeholder is on board.

While we can’t share exact details due to confidentiality, let’s take a media product whose traffic is stagnating and is mostly inorganic, but once there, users tend to browse and click through a couple of articles. In contrast, though, revenue is more like a brook than a stream.

Stretching boundaries

At times, your organization simply lacks various key capabilities for success, such as ad management competencies or a high-level, all-encompassing strategy. While these are not easy fixes, addressing these will significantly contribute to your product’s end results.

The list of factors influencing your success is practically endless, and includes some less obvious ones as well. A proper product discovery process digs deep into enablers and barriers not just in your product, but the organizational structure around it.

While an initially unplanned goal, a significant outcome of our project was the alignment and commitment of the entire team after the PD process, ensuring long-term alignment within the organization. Seeing everyone team up for the common goal boosted our spirits as well, even though we were pretty pumped about the project to begin with.

Map your environment

The research phase begins with understanding your surroundings. This includes the market you operate in, the competitors in your field, as well as the available technologies that can support your goals.

As for Central, we researched both Hungarian and international health media to map solutions and the problems they address, their business and revenue streams, and the business value chain in the home health market. At the same time, it’s worth noting the common barriers the entire market faces (such as regulatory environments and human habits), as well as innovative solutions to tackle these.

In this phase, methods are the ol’ reliables of the field. A bunch of desk research, cross-referencing solutions of various market players, and aiming to find the most unique features of each to help you position yourself in the crowd.

Moving forward with the example case study, let’s assume a highly competitive market, as most online media outlets compete in. In health media, this is coupled with pretty strict regulations pertaining to medical advice. As a result, solutions and technologies tend to converge and homogenize, which poses a challenge. How do you stand out in such a fierce market and maintain your lead?

This is where finding your own secret sauce comes into play, and Product Discovery shines.

Talk to your users to talk to your users

User research is arguably the most significant part of the entire process. Even if you create something that’s never been done before, and have the entire org chart supporting you, it all depends on whether your audience likes what you offer.

To find out what they’re after, we conduct both quantitative and qualitative research. In the case of Central Media group, we looked at how people relate to their health, what tools they use and how, what they think of home remedies, what motivates them, and what problems they face when looking into health topics.

At the same time, it’s important to explore how users relate to your brand and product. A favorable perception is a great place to start, but negative connotations are even more important to be addressed. Otherwise, you’re ignoring a barrier that might set you back down the line.

It’s worth noting that different users have different expectations towards the sources they use. In case of a health portal, a mother taking care of her kid down with the cold will be looking for vastly different things compared to a doctor who’s looking up the exact list of active agents in a drug. Thus, the problems they face will be different as well—make sure to accurately define your audience in this phase.

The task doesn’t end here, though, as interpreting answers and turning them into actionable insights is just as important. While no two people are the same, good research allows you to form user clusters that can further support your product choices.

Are you offering solutions to sporty, health-conscious people looking to make the most out of their workouts, or will you be the most reliable source of in-season healthcare for allergies and the common flu? For simplicity’s sake, let’s go with the first group, but note that in real-life cases it’s usually more complex than this.

These clusters are looking for different details, and focusing on one or a select few of them will help you define your product’s outlines and your desired user journeys.

It is a crucial part for your strategy, since you have to select your target groups based on the size of the groups, their insights and needs, to whom you can deliver the most value, in consideration of your business model.

Ideate and evaluate

With all preliminary research done and user journeys created, time to return to the drawing board to ideate and evaluate, taking into account everything from before. However, it needs to be more than a great product idea, and must support business goals as well.

In the example, we aim to uplift an online media product from stagnation, surrounded in a so-called “red ocean”—a highly competitive market with several established names. If left without innovation, the lack of organic traffic would eventually erode the brand. We’ll decide to focus on a group of young, health-conscious people who are tech-savvy, and always on the move.

Instead of purely idea generation, our methodology also focuses on feasibility and long-term sustainability. This includes:

- Target group selection and estimation of the portion of the user base who would appreciate the product/feature

- Organizational compliance evaluation (whether they have all the necessary tools, personnel, and resources available)

- The product’s impact on the market and the organization

- And of course, direct and indirect revenue stream estimations

Chart your journey

In our methodology, the keyword is collaboration. We aim to supply UX designers with enough information to create wireframes and prototypes that we can later test with a select group of users. These user tests are the backbone of the process. They can reveal users’ opinions on how valuable certain functions are, how they navigate the UI, and whether they have any ideas to make it better suit their needs.

Due to the sheer amount of feedback and new ideas from testers, this is where the design thinking process gets busy. Prototyping, testing, and fine-tuning new additions are a highly iterative process.

Only by combining all previous research, UX principles, and live feedback are we able to deliver something that wows not only our clients but users and the market as well.

It’s important that you rely on previous findings when evaluating certain solutions.

During feedback sessions, it’s best if you rely on the target group you previously identified–health-conscious people–, and reflect on market conditions, how the current iteration lives up to expectations and competes with existing solutions, and how much value your desired target group receives from it. The end result: an easy-to-navigate portal with up-to-date news on healthy diets, with subscription-based, personalized options, recommendations for seasonal sports, and a pick-up group finder for your city—all accompanied with a handy mobile app.

Keep exploring

Sticking to Design Thinking’s framework, a product discovery process takes only a few sprints. The end results are detailed short, medium, and long-term strategies, and as such, the first steps can be taken immediately. This includes product aspects (what the end product should look like and what goals it will contribute to), as well as organizational functions that make all of this possible. Think restructuring certain functions in the workforce, hiring new content writers, or changes to day-to-day operations, for example.

In our cooperation with Central Media Group, we also focused on brand development, service design, and compiling a go-to-market (GTM) strategy.

As for our example case, while developing an entire mobile app from scratch may take a month or two, content strategy can be revamped rather quickly, while your comms teams can work on a rollout campaign for the final product for the coming months.

This showcases not only how a well-defined product strategy can help your business grow, but the fact that it’s a group effort. Having the entire team on board is crucial for the strategy to succeed, and we strongly recommend focusing on it in the kick-off period.

However, like all good adventures, it doesn’t have to end there. Keeping the created strategy in mind, you can iterate later using the same methodology, but with a much wider array of starting data, securing your spot at the top of the market.

We believe that this is where Appic’s strengths come into play. By combining strategy with hands-on implementation and support, we offer an end-to-end service, combining research, resource estimates, as well as revenue forecasts. As such, we don’t only help our clients design a roadmap for success, but support them in paving the path as well, be it a fresh native app or a daring solution built around multi-agent systems.

You can check out ours and Hiflylabs’ case studies on how we contribute to a wide range of industries over on our Case Studies page.